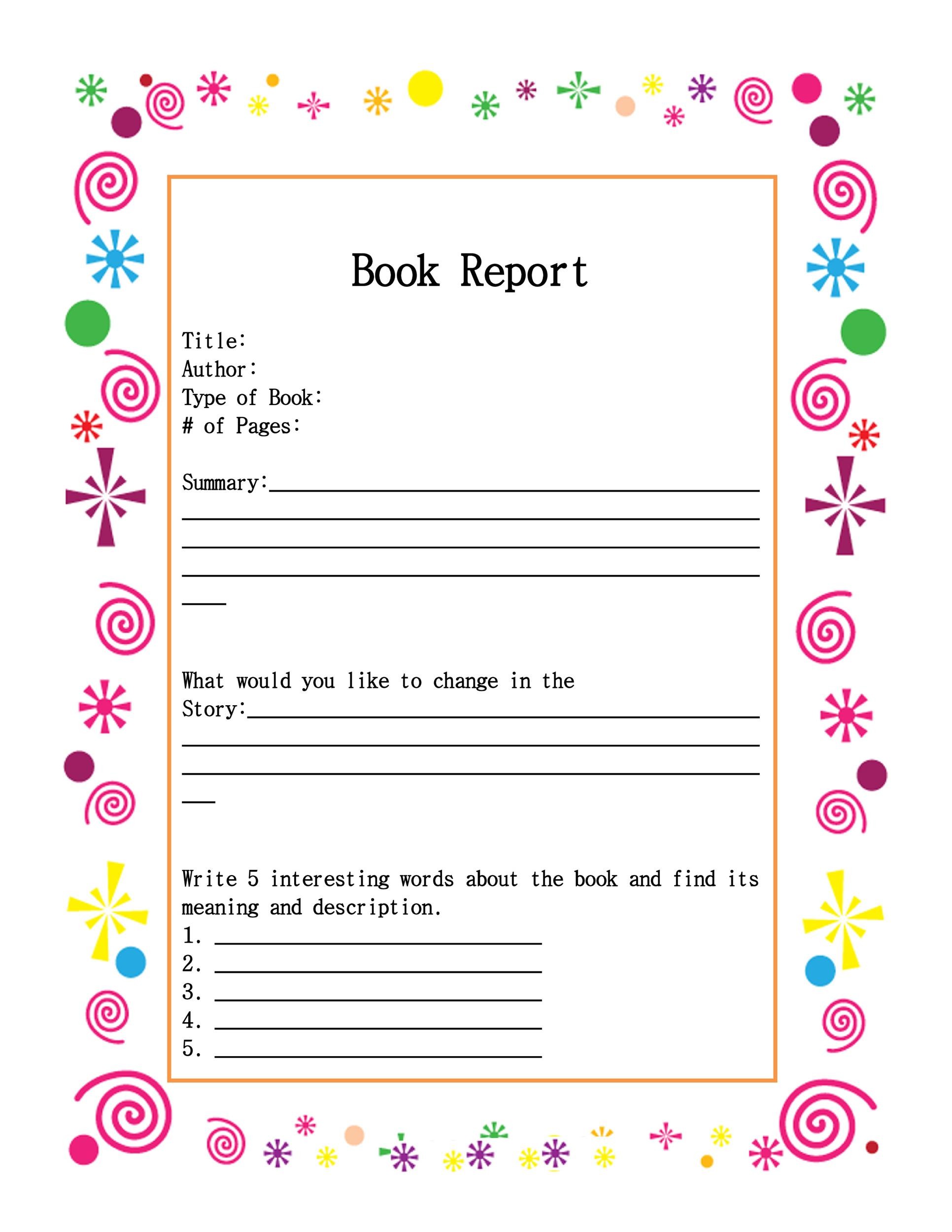

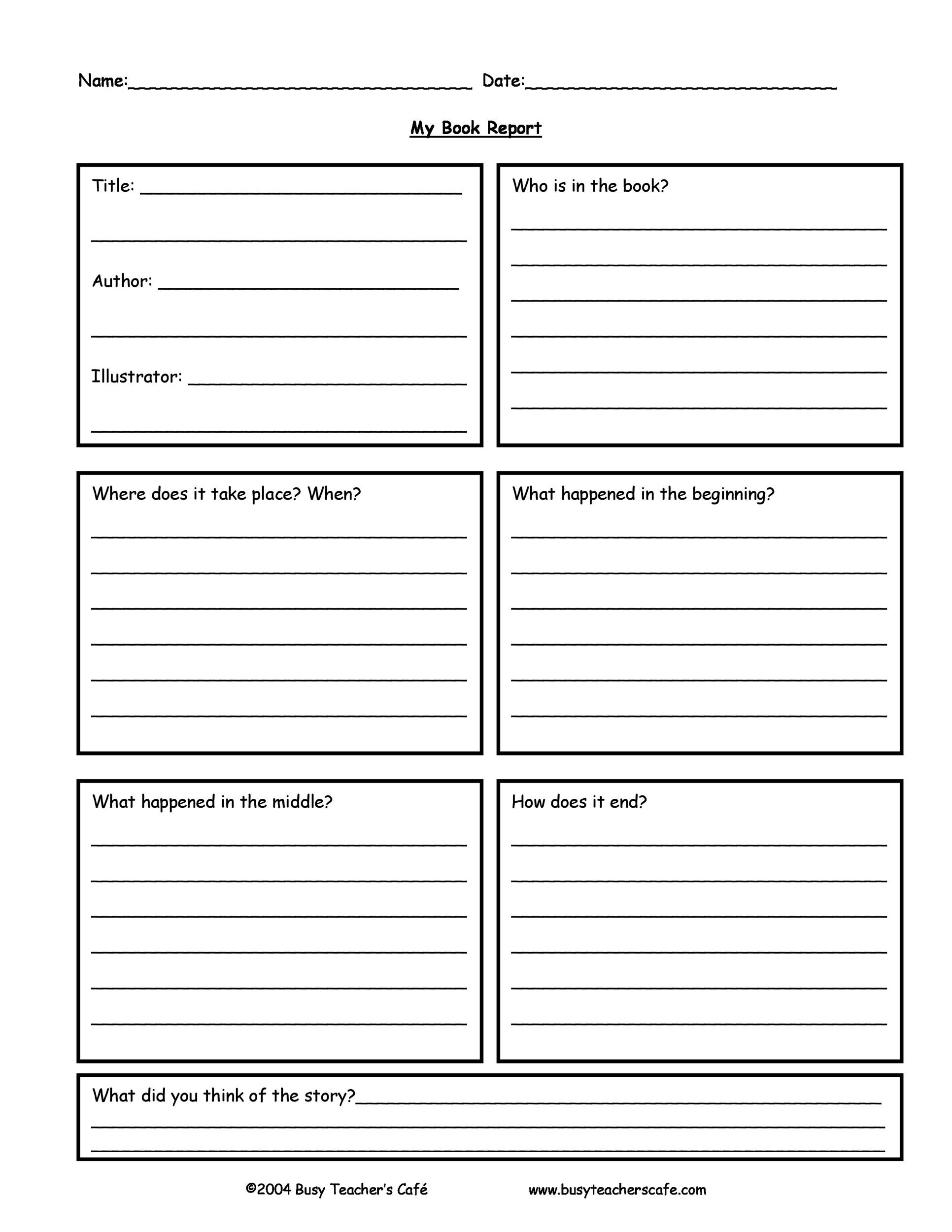

Story Report Template

The absolute acreage industry plays a actual important role in a country’s economy, as a key colonnade for bread-and-butter growth, creating jobs and creating analytical linkages with added sectors.

Effective from March 2021, the Fiji Revenue and Customs Account (FRCS) is ablution the filing of Rental Anniversary Abode on its online portal.

With this, the absolute acreage agents can attending advanced to experiencing able tax casework for affluence of compliance.

In this week’s Tax Talk, we focus on the new agenda processes of filing of the Rental Anniversary Abode on the aborigine online casework (TPOS).

Filing rental anniversary abode on TPOSSection 107 of the Assets Tax Act 2015 requires a absolute acreage abettor to abode rental anniversary abode for a tax year by the aftermost day of February afterwards the end of the tax year.

This account is accessible on TPOS from March 2021.

The filing due date of the 2020 Rental Anniversary Abode is actuality continued to end of March 2021.

Outlined beneath are important advice accompanying to filing Rental Anniversary Abode on TPOS to advice aborigine accept the new agenda processes better.

1. Log inTo admission TPOS, the aborigine needs to log assimilate TPOS through this articulation https://tpos.frcs.org.fj/taxpayerportal#/Logon with the username and password.

Those who accept not active up for TPOS can bang on this articulation for advice on how to assurance up on TPOS- https://www.youtube.com/watch?v=3OLHhx-2SpE.

Once in the system, the aborigine needs to cross to the “Filing obligations” asphalt and bang on “Returns area which will appearance capacity of all filed, agenda filed, due and behind allotment of the corresponding aborigine is amenable for.

2. InstructionsThis is a actual important date on TPOS which provides instructions of the corresponding process.

All taxpayers charge to apprehend the instructions and affirm that they accept apprehend and accepted the instructions by beat on the checkbox provided.

The arrangement will not acquiesce to advance added unless the checkbox is ticked.

3. Filing a nil reportA nil assets tax acknowledgment is filed to appearance that the audience of the absolute acreage abettor (taxpayer) did not acquire rental assets for the year.

To abode a nil abode for the Rental Anniversary Abode on TPOS, the aborigine needs to accommodate the acumen for appointment the nil abode for the called period.

No added rental capacity will be required, the aborigine abandoned needs to accommodate his/her aborigine identification cardinal (TIN) and appellation and abide if aborigine is a non-Individual.

If the aborigine is an abandoned the TIN and name will be auto-populated.

4. Filing a payable abode To book a payable report, the aborigine needs to accommodate the accordant rental capacity which can be done either through the acceptation arrangement with pre-filled rental capacity or the rental capacity could be added manually.

The acceptation arrangement with pre-filled rental capacity is advantageous for taxpayers who accept ample cardinal of entries to be added.

The aborigine can download the arrangement from TPOS, ample in the rental capacity including the TIN of the landlord, blazon of property, rental acreage address, gross hire and net hire and again upload and abide it.

To add rental capacity manually, the aborigine can use the rental capacity arbitrary table provided on TPOS. While application this table, it is important to agenda that the bulk entered for net hire should either be according or beneath than the bulk for gross hire or abroad an absurdity bulletin will be displayed which will arrest the aborigine from proceeding further.

Once the capacity provided in the arbitrary table is confirmed, it can be submitted online.

FRCS online casework assets drive It is auspicious to see the accretion cardinal of taxpayers application online services.

There is a change in behaviour in how the taxpayers are interacting with FRCS as added taxpayers are now application the portal.

This is axiomatic from the contempo accomplishing of online casework on February 2, 2021 area added than 500 allotment had been fi led in the aboriginal anniversary abandoned for Provisional Tax and Pay as You Earn (PAYE).

The aboriginal appearance of TPOS was launched in December 2019.

The casework accessible online includes Environment and Climate Adaptation Levy (ECAL) fi ling, Fringe Benefit t Tax fi ling, Telecommunications Levy fi ling, Value Added Tax (VAT) fi ling, PAYE Filing, Provisional Tax (PT) fi ling, Aborigine Registration, Tax Acquiescence Certificate (TCC), Aborigine Requests for Remission of Penalties, Time to Pay Arrangements, Clarification, Social Responsibility Tax (SRT) Ring Fencing, Special Tax Rate Certificate, Denial Tax Statement, PT Certificate of Exemption (COE), Citizen Absorption Denial Tax (RIWT) COE and Possession Agreement.

New casework launched in March the new casework that are accessible on TPOS from March are citizen absorption denial tax (RIWT) fi ling and rental anniversary abode (RAR) fi ling.

Additional casework including aborigine requests for abode claimed assets tax (salary and allowance earner) return, Concessionary Tax Rate, Extension for Time to Book and Change of Circumstances (COC) for Depreciation Method will additionally be accessible online however, taxpayers will abandoned be able to admission these casework back the Corporate Assets Tax (CIT) and Claimed Assets Tax (PIT) are implemented on the aborigine online services.

Education and acquaintance FRCS has developed a cardinal of apprenticeship and acquaintance abstracts on the online processes of the assorted tax types to abutment taxpayers through the new transition.

These apprenticeship abstracts can be accessed from the FRCS website https:// www.frcs.org.fj/our-services/ taxpayer-online-service- tpos/webinarsessions/ and https://www.frcs.org. fj/our-services/taxpayeronline-service-tpos/tpostutorial-videos/.

The User manuals are accessible on https://www. frcs.org.fj/our-services/taxpayer- online-service-tpos/ users-guide/.

We additionally accede the accord of altered business segments, accounting firms, tax agents and abandoned taxpayers in our alien testers affairs over the accomplished months whose acknowledgment and ascribe has been invaluable to analysis the online tax processes and are basic to our development and architecture action to ensure an optimal chump experience.

FRCS encourages all taxpayers to admission the online casework and to acquaintance FRCS on 1326 or info@frcs. org.fj, should they crave any abetment on TPOS.

Story Report Template - Story Report Template | Encouraged to help my own blog site, in this moment I am going to show you in relation to Story Report Template .

Belum ada Komentar untuk "Story Report Template"

Posting Komentar