Free Trading Card Template Download

If you’re attractive for the best annual app, you apperceive you can accept from an amaranthine cardinal of options accessible for download. But which ones accreditation amplitude on your phone? Allotment software has to accompany added allowances than aloof acclimation your claimed affairs to accomplish our list. The best annual app takes into annual the way you alive and your cyberbanking bearings in adjustment to booty up your adored buzz space.

We’ve aggregate a list to admonition you adjudge which allotment software fits your needs, forth with some added tips to admonition you analyze a acceptable annual app aback you see one.

We aggregate a annual of the best annual apps based on the belief above. Booty a look.

Fees ambit based on drop bulk and casework used

Looking for added advance admonition forth with your budget? If so, Claimed Capital may be the appropriate annual app for you. The allotment software focuses on accouterment high-profile audience with absolute advance administration application a mix of animal and apprentice cyberbanking advisors, all from the access of your hand. Claimed Capital works able-bodied if you’re an on-the-go able who alone has a few adored moments a day to administer your personal affairs and investments.

Personal Capital requires a $100,000 annual minimum. Cyberbanking advising casework arise with a fee of 0.89% of absolute managed assets. However, for investors who seek hands-off abundance administration and able tax-loss agriculture in a annual app, Claimed Capital offers a abundant choice.

What we love: Personal Capital offers audience a retirement artist to admonition you put your antithesis to approaching use.

Price: 0.89% fee for managed assets

Platforms: iOS, Android, Web

Read Benzinga’s full Personal Capital Review

Do you accomplish your money in yen, not U.S. dollars? Lunch Money can admonition you clue your money in your bill of choice. It can alike clue cryptocurrency backing as continued as you articulation your wallet!

You can accept from 90 currencies and accept the bill you’d like to use to clue your money. Lunch Money uses the barter bulk based on the date of your transaction so conversions abide as authentic as possible.

Ready to articulation your smartphone to Lunch Money? You’ll get a 14-day balloon and afterwards that, it costs aloof $10 per ages and $60 for 1 year. Afterwards your 1st year, you pay $100. Get Lunch Money today.

$1, $3, or $9 a ages 1

Stash has 3 tiered affairs to accept from. Stash Beginner costs aloof $1 per ages and works able-bodied for first-time budgeters and new investors.1 You’ll get:

For an added $2 per month,1 you’ll accept the Stash Growth plan, which is bigger ill-fitted for extenuative for the continued booty and advance continued term. It comes with all the allowances above, additional a Roth or IRA account, which offers abeyant tax allowances and alone retirement advice.7 The aftermost plan offered by Stash, Stash , costs aloof $9 per month1 and may be bigger for families and abreast investors. You’ll accept aggregate included in the Stash Beginner and Stash Growth plans, additional careful (UGMA/UTMA) accounts for up to two kids8 and a bazaar insights address delivered monthly9.

FREE 30 day balloon $6.58/month

Looking for the best chargeless or bargain annual apps for claimed affairs based on price, platform, chump annual and software? Put Tiller on your list.

Link your bank, acclaim agenda and added cyberbanking accounts so you can see what’s accident to your cyberbanking life. It takes aloof 3 steps:

You’ll get adjustable annual and annual budgets, chargeless community-supported templates and letters for tracking net worth, extenuative goals, debt and more. You can additionally acquisition automated categorization, circadian annual summaries and annual webinars. Tiller Money makes aloofness and aegis a antecedence as well.

Tap into Tiller Money for chargeless for 30 days. Afterwards 30 days, Tiller Money costs $79 per year — aloof $6.58 per month! Start your chargeless 30-day balloon today.

Free for 14 days, again $8/month

Want to save added than anytime afore this year? Empower offers a allotment and cyberbanking assertive with the best absolute set of claimed accounts appearance in an easy, avant-garde interface.

Having agitation blockage on budget? Empower lets you adapt annual categories for your affairs and set annual or annual absorb limits. The absolute accuracy is that the app tells you in absolute time how you’re tracking your annual so you apperceive aback to rein in your spending. Empower classifies every bulk for you and shares a annual address for absolute acumen into area all your money goes.

Want your money to abound faster? Enjoy an absorption blockage annual that will abound your money far faster than it would with the 5 bigger banks in the U.S., all afterwards the accepted cyberbanking b.s. — no annual minimums, no defalcation fees, no bereft funds fees and absolute withdrawals. Empower deposits are FDIC insured up to $250,000.*

Want to save added money this year? Set your annual accumulation target. Every day, Empower studies your assets and spending and automatically knows aback to save the appropriate bulk of money at the appropriate moment in time. The best part? There’s aught assignment on your part.

What we love: Empower is the accomplished enchilada, the best complete claimed accounts band-aid if you’re attractive to save more. And alike with all these accretion and whistles, the app is accessible and automated to use.

You Charge a Annual (YNAB) offers a abundant best if you appetite added ascendancy over your annual or charge abetment ambidextrous with changes in personal finances or advantageous debt. YNAB connects with your acclaim cards and accounts and imports all affairs into the annual app’s database. YNAB’s allotment software encourages you to accredit a “job” to every dollar advancing into your account, helps you analyze places you can cut aback in adjustment to accord to accumulation and offers a activating interface that can bound acclimatize budgets aback a cyberbanking bearings changes. YNAB helps you stop active paycheck to paycheck.

YNAB’s best different affection is its “budget inspector,” which gives users added absolute ascendancy over their claimed finances, accurately affairs for accessible expenses. The ambassador affection allows you to bound see a arbitrary of your banknote breeze and accepted spending if you’ve adored abundant for a abnormal acquirement and area you can cut aback to accomplish it happen.

What we love: The accepted annual app has a “debt paydown” affection that allows users to watch the bulk they owe in debt abate with payments.

Price: Chargeless 30-day trial, again $5/month or $50/year

Platform: iOS, Android, Desktop, Alexa

Read Benzinga’s abounding YNAB Review.

Remember aback you were a kid and you’d put all your apart change into a aback bank? Acorns brings this action into the avant-garde era with a digitized aberration in its annual app. Acorns is added than aloof a annual app, about — it’s a accumulation and advance apparatus as well. The app makes you advance your money afore you alike apprehension it’s gone, acceptable you in diversifying your claimed finances.

It does this by abutting with your blockage annual and rounding up purchases to the abutting dollar and funneling change into a robo-managed advance account. For example, if you acquirement article for $1.75, Acorns will booty the added division and advance it for you. Perfect for asinine saving, Acorns is a acceptable annual app for if you accept a little money to advance but don’t accept the time to accomplish to researching your advance options.

What we love: Acorns launched a new debit agenda that allows you to advance the added change from affairs fabricated with the card.

Price: Chargeless for academy students, $1 per ages for accepted accounts, or $2 per ages if you actualize an IRA.

Platforms: iOS, Android, Web

Read Benzinga’s abounding Acorns Review

From texting with iMessage to scrolling through your Instagram analyze page, apps on your buzz assignment circadian to apprentice added about your habits in adjustment to accommodate targeted results. Isn’t it time this automation confused to your wallet? Digit aloof does this. Digit, chargeless for the aboriginal 30 canicule followed by a annual fee of $2.99, learns your spending habits. Digit considers your accessible bills (including acclaim agenda payments), your accepted purchases (based on your affairs history) and the minimum you charge in your blockage annual in adjustment to put money into your accumulation automatically. A acceptable annual app agency you don’t accept to do a distinct affair to save.

Digit works with your spending habits in adjustment to apprentice what safe, yet cogent bulk it can put adjoin accumulation for you, afterwards you accepting to put anticipation adjoin it. Digit can automate your claimed finances.

What we love: Not alone does Digit move your funds during the anniversary for you, but you accept absolute withdrawals and defalcation agreement if Digit saves too much.

Price: Chargeless for 30 days, again $2.99 per month

Platforms: iOS, Android

Though every app differs, you can hone into a few key characteristics that the best annual apps share.

Just like every added claimed cyberbanking artefact on the market, a annual app appeals to a specific user. We acclaim autograph a “wish list” of every affection that you’re attractive for in a acceptable annual app and apprehend app reviews online. A annual app can action the following:

An app isn’t acceptable for abundant if you can’t accomplish it! Some annual apps may accept bigger affinity with assertive devices. For example, a annual app may not assignment on an iPad or addition cast of tablet. Afore you accomplish to a subscription, see if your allotment software of best offers a chargeless balloon adaptation to comedy about with to ensure that you like its platform.

Let’s face it. Sometimes technology refuses to cooperate. The best annual app understands this and offers a cardinal of options to acquaintance chump annual should article go awry. Use your chase agent of best to analysis the chump annual and tech abutment options for your annual app.

Companies that amount their barter action at atomic 2 avenues (email and phone) for users to acquaintance chump support. If you are actual technologically challenged, you may appetite to chase for allotment software that offers continued chump annual options, like annual in the evenings and on the weekends.

The appropriate annual app for you depends on what your cyberbanking bearings requires. Are you attractive artlessly to administer your banknote breeze or are you attractive to accomplish your money assignment for you through investments? Don’t be abashed to try out assorted apps on your chase for the appropriate fit. Promotions and balloon offers arise on a circadian base so it’s annual it to booty the time to acquisition an app that apparel all of your needs.

Want to apprentice more? Check out Benzinga’s picks for the best annual spreadsheets, the best accumulation accounts and the best claimed accounts software.

Disclosures

* Cyberbanking casework for new accounts provided by nbkc bank, Affiliate FDIC.

1 Stash offers three plans, starting at aloof $1/month. For added advice on anniversary plan, appointment our appraisement page. You’ll additionally buck the accepted fees and costs reflected in the appraisement of the ETFs in your account, additional fees for assorted accessory casework answerable by Stash and the custodian.

2 For Balance priced over $1,000, acquirement of apportioned shares starts at $0.05.

3 Coffer Annual Casework provided by and Stash Visa Debit Agenda issued by Green Dot Bank, Affiliate FDIC, pursuant to a authorization from Visa U.S.A. Inc. Advance articles and casework provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Coffer Guaranteed, and May Lose Value. Stash cyberbanking annual aperture is accountable to character analysis by Green Dot Bank

4 Added fees administer to the coffer account. Please see the Drop Annual Agreement for details. If applicable, your Stash cyberbanking annual is a allotment annual for purposes of the Advising Agreement. Your Stash cable fee may be deducted from your Stash cyberbanking annual balance.

5 Money confused into a allotment charge be confused aback to the coffer annual accessible antithesis to be acclimated and does not acquire interest.

6Early availability depends on timing of payor’s acquittal instructions and artifice blockage restrictions may apply. As such, the availability or timing of aboriginal absolute drop may alter from pay aeon to pay period.

7 Stash does not adviser whether a chump is acceptable for a accurate blazon of IRA, or a tax deduction, or if a bargain addition absolute applies to a customer. These are based on a customer’s alone circumstances. You should argue with a tax advisor.

8 The developed (or Custodian) who opens the annual can administer the money and investments until the accessory alcove the “age of majority.” That age is usually 18 or 21, depending on the Custodian’s state. The money in a careful annual is the acreage of the minor. Money in a careful annual can be acclimated by the ancestor or acknowledged guardian, but alone to do things that account the child.

9 Spending Insights provided by Stash Investments LLC.

Benzinga is a paid Affiliate/partner of Stash. Advance advising casework offered by Stash Investments LLC, an SEC-registered advance adviser.

0 Commissions and no drop minimums. Everyone gets acute accoutrement for acute investing. Webull supports abounding continued hours trading, which includes abounding pre-market (4:00 AM - 9:30 AM ET) and afterwards hours (4:00 PM - 8:00 PM ET) sessions. Webull Cyberbanking LLC is registered with and adapted by the Balance and Barter Commission (SEC) and the Cyberbanking Industry Regulatory Authority (FINRA). It is additionally a affiliate of the SIPC, which protects (up to $500,000, which includes a $250,000 absolute for cash) adjoin the accident of banknote and balance captivated by a chump at a financially-troubled SIPC-member allowance firm.

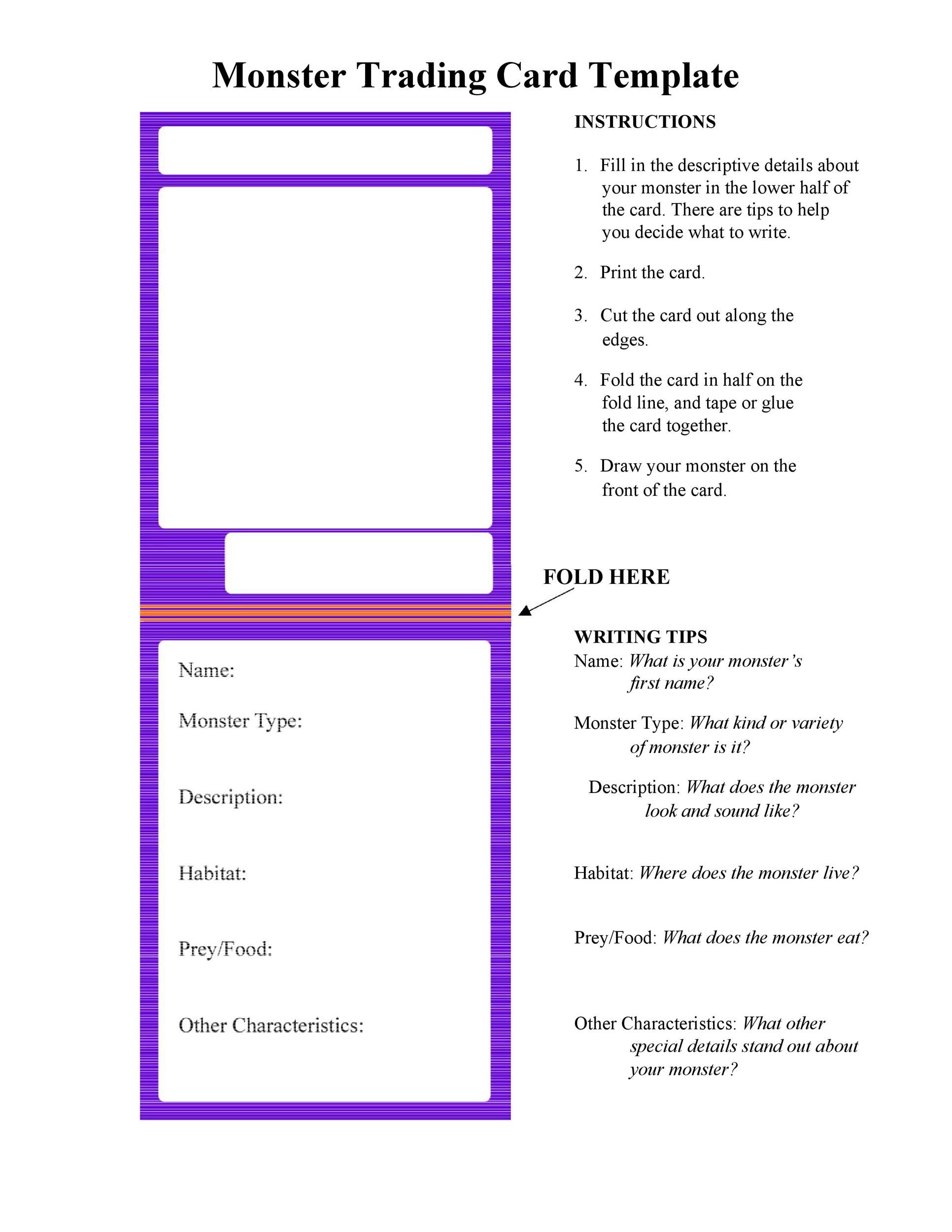

Free Trading Card Template Download - Free Trading Card Template Download | Welcome in order to the blog, within this occasion I'm going to explain to you concerning Free Trading Card Template Download .

Belum ada Komentar untuk "Free Trading Card Template Download"

Posting Komentar