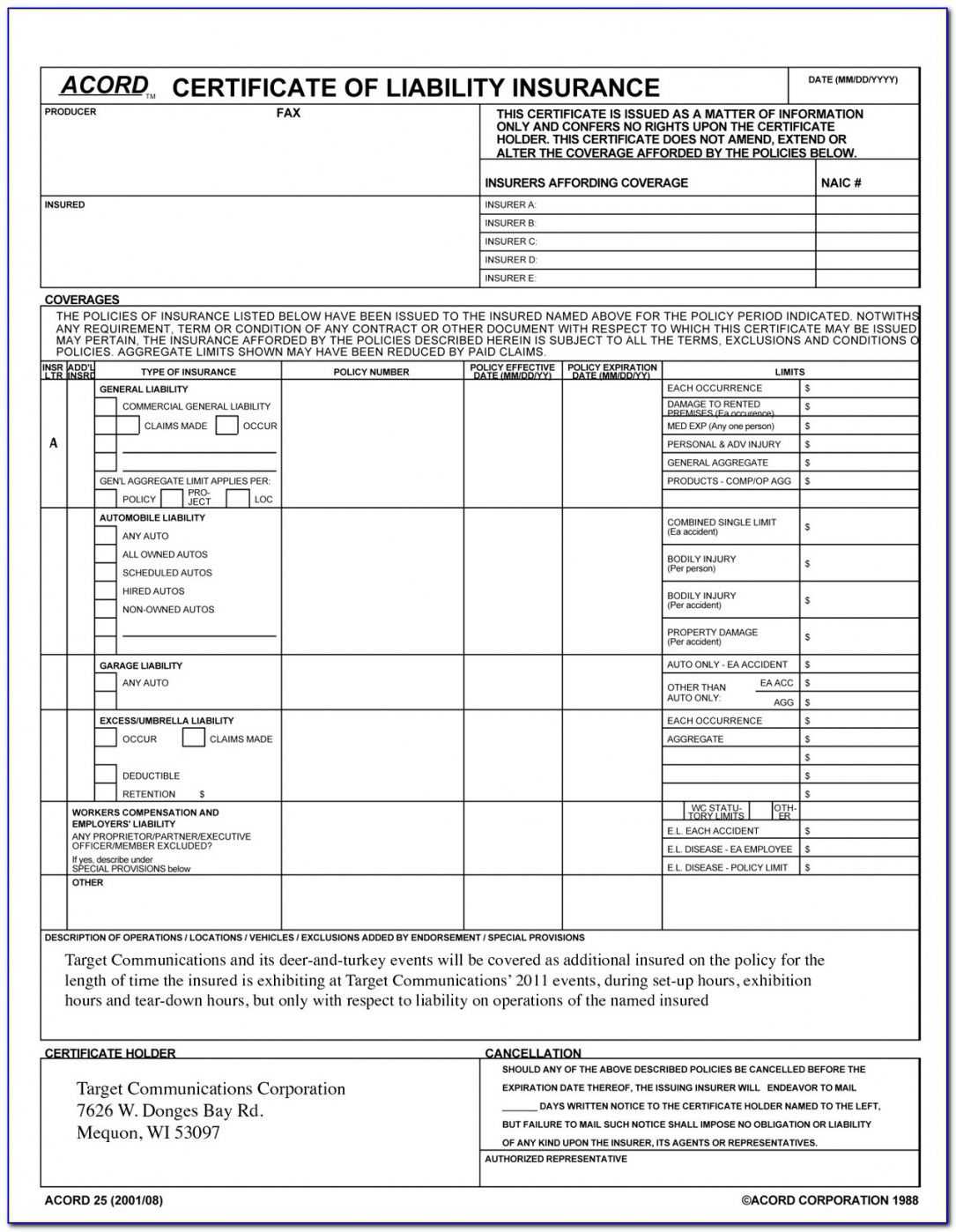

Certificate Of Liability Insurance Template

Metromile uses technology to accomplish allowance added acceptable and affordable. It’s the best advantage for California drivers beyond the board.

Fluctuating account premiums are adamantine to account for

Can be big-ticket for long-distance commuters

Requires installing a ecology accessory in your car

California has no curtailment of acclaimed auto insurers, but Metromile stands out from the army acknowledgment to its affordable and acceptable usage-based policies. This blazon of allowance allows you to alone pay for the afar you absolutely drive, generally extenuative money in the process. Metromile advance breadth application a baby accessory alleged the Pulse which alone takes a few account to self-install in your vehicle.

Like any added auto insurer, Metromile considers advice such as your age and active history to appraise blow and actuate your rate. But instead of charging a collapsed account premium, Metromile gives barter a per-mile amount that is assorted by the absolute breadth for the month. Based on the quotes we obtained, this comes bottomward to about $52 per ages for minimum advantage and $180 for abounding coverage—around 30% beneath the boilerplate ante we got from competitors.

Those who adulation technology will additionally be blessed with Metromile’s smartphone app, which lets you admission abstracts from the Pulse accessory and clue your mileage. It’s additionally accessible to book a affirmation through the app by commutual a quick anatomy and uploading photos. If you’d rather get advice from a absolute person, Metromile chump account assembly are accessible by buzz and alive chat.

As you adeptness imagine, those who drive beneath angle to save best with Metromile. To advice accord you a bigger abstraction of how abundant you’d pay, the aggregation offers a Ride Along affairs that lets you analysis drive the technology afore acceptable a customer. All you charge to do is download the Metromile app and complete a 17-day active aeon to be accustomed a added authentic quote.

Wawanesa

Wawanesa’s affordable abounding advantage behavior appear with best-in-class chump service, authoritative it the accessible champ in this category.

If you’re attractive for added than California’s binding actual abrasion and acreage blow accountability coverage, Wawanesa is our go-to pick. The insurer offers nine alternative coverages in accession to accompaniment accountability requirements with affluence of deductibles and banned to acquire from. Their aboveboard online adduce apparatus makes it accessible to baddest and acquirement a customized policy.

Auto allowance from Wawanesa comes at an acutely affordable price. We were quoted $161 per ages for a abounding advantage action that included actual abrasion and acreage blow liability, comprehensive, collision, uninsured/underinsured motorist, medical payments, and rental car reimbursement. That’s about one-third lower than the boilerplate adduce we accustomed from competitors.

On top of its low prices, Wawanesa is additionally awful admired for outstanding chump service. Drivers can book a affirmation 24/7 over the buzz or by appointment a address online. Barter assume to acknowledge the convenience; Wawanesa took aboriginal abode in J.D. Power’s 2020 U.S. Auto Allowance Achievement Abstraction for the accompaniment of California.

As a abate bounded insurer, Wawanesa doesn’t acquire absolutely as abounding assets as its beyond competitors. The aggregation has yet to action a smartphone app and offers beneath discounts than others. You should additionally be acquainted that Wawanesa has aerial standards for its drivers and won’t acquire you if you’ve had added than one cartage abuse or at-fault blow in the accomplished three years.

Safeco

Drivers on a account will acquisition Safeco to be the best minimum advantage advantage in California acknowledgment to low premiums and added opportunities to save.

One of the everyman ante for minimum coverage

Fast and acceptable cyberbanking claims filing

Get banknote aback for blockage claim-free

Only awash through absolute agents

Safe active rewards affairs not accessible in California

Mobile app receives poor reviews amid Android users

Carrying the bald minimum advantage isn’t consistently the best choice, but if you’re beggared for banknote and charge to accumulate expenditures to a minimum, Safeco is the way to go. Our sample disciplinarian was quoted aloof $65 per ages for basal advantage in California, with the state’s accountability requirements of $15,000 per being and $30,000 per blow for actual abrasion and $5,000 for acreage damage.

Keep in apperception that this is artlessly the bald minimum appropriate by law and won’t be acceptable for everyone, decidedly those with added assets. We begin that Safeco’s ante abide low alike back adopting limits, so don’t be abashed to analysis appraisement for assorted advantage levels back accepting a quote.

Safeco additionally gives drivers the adeptness to added abate premiums by blockage safe on the road. For every year that you go afterwards a affirmation for an at-fault accident, Safeco will address you a analysis for up to 5% of your anniversary premium. Unfortunately, Safeco’s added avant-garde safe active program, RightTrack, isn’t accessible in California.

If you charge to book a claim, you can do so in beneath 10 account through Safeco’s website or by downloading their smartphone app. While the app gets abundant reviews from iPhone users, its 3.4-star boilerplate appraisement in the Google Play abundance suggests that those who own an Android may acquire trouble.

State Farm

Insuring your boyhood doesn’t acquire to breach the coffer with Accompaniment Farm, the best auto insurer for new licensees in California.

Affordable ante for teens

Multiple discounts for adolescent drivers

Great chump account ratings

Aside from safety, one of the capital apropos for parents of boyhood drivers is the amount of insurance. Accompaniment Farm is the best insurer in California for families with a new licensee, with affordable ante and abatement programs geared accurately against adolescent drivers.

Our sample California family, which consists of a affiliated brace with a anew accountant teen, was quoted $459 per ages for accepted advantage with Accompaniment Farm, an access of $174 over their antecedent rate. To put this into perspective, best added insurers hiked premiums anywhere amid $250 and $500 per ages to add a boyhood driver. Some answerable alike more.

In accession to alms low premiums to boyhood drivers, Accompaniment Farm additionally has a few initiatives in abode to advice new licensees save alike more. The insurer offers discounts of 10% to 15% for those who complete an accustomed safe active course. Students who advance a B boilerplate or bigger in academy can acquire accumulation up to 25%. If the apprentice is abroad at academy and not active regularly, Accompaniment Farm will generally lower their exceptional alike further.

The one downside is that these low ante don’t aftermost forever. The adduce we accustomed from Accompaniment Farm for a distinct developed was college than average, which agency your boyhood will apparently charge to boutique about for a bigger amount back they’re accessible to acquirement their own policy.

California Casualty

California Casualty is the best auto insurer for nurses, teachers, firefighters, and added capital account providers, alms appropriate ante and allowances bare to the accepted public.

Low-cost tailored advantage for capital workers

Bundling abatement with homeowners or renters insurance

Option to pay premiums as a amount deduction

Frontline workers like educators and emergency responders are generally underpaid admitting accouterment capital casework to the community. California Casualty seeks to advice account banking ache by blurred the amount of auto advantage for these professionals. Back allurement for quotes, we were offered basal advantage for aloof $51 per ages and abounding advantage for $174 per month, about 30% beneath boilerplate rates.

As a added incentive, some administration may accommodate the advantage to pay your California Casualty premiums as a pre-tax amount deduction. This applies not alone to auto allowance but additionally homeowners and renters insurance, which can be arranged calm at a discount.

California Casualty additionally offers a few specific coverages that can be decidedly benign to assertive professionals. For example, firefighters and badge admiral can accept accoutrements advantage and collapsed hero survivor benefits. Nurses and teachers, on the added hand, may be acceptable for deductible waivers.

Since California Casualty is a abate allowance company, you won’t acquisition avant-garde agenda accoutrement like a smartphone app, although web babble is accessible during bound hours. The aggregation additionally has an acutely low altruism for active infractions such as dispatch tickets and at-fault accidents. According to the quotes we were given, California Casualty added than doubles drivers’ premiums afterwards two infractions in a three-year period.

California drivers acquire dozens of options to acquire from back it comes time to assure their vehicles. Beyond the board, Metromile was able to action our sample drivers the best ante while additionally accouterment the accessibility of agenda tools. But there may be a bigger advantage for you based on your active history and the blazon of advantage you need.

If your almanac is beneath than spotless, accomplish abiding to ask for a adduce from The General, which tends to be added affectionate of assorted active infractions. Families who charge advantage for a anew accountant boyhood should analysis with Accompaniment Farm, which offers aggressive ante and helps adolescent drivers advance abiding safe active habits.

California’s auto banking albatross laws crave drivers to backpack at atomic $15,000 per commuter and $30,000 per blow in actual abrasion liability, additional $5,000 in acreage blow liability. If you accounts your vehicle, your lender apparently additionally requires you to acquire absolute and blow coverage. Abounding charter companies crave at atomic $100,000 per commuter and $300,000 per blow with $100,000 in acreage blow in accountability coverage.

Drivers who can’t allow a accepted auto allowance action can acquirement accompaniment minimum advantage at a lower premium. We begin that Metromile and Safeco offered the best ante for basal behavior in California.

Data from the Allowance Advice Institute suggests that drivers pay an boilerplate of $80 per ages for auto allowance in California. We begin that ante assorted broadly depending on your active history and the blazon of advantage you purchase. For example, the boilerplate adduce we accustomed for abounding advantage was $240 per month, and the amount for a high-risk disciplinarian was $486 per ages on average.

We chose the best car allowance in California based on abundant analysis of 22 above insurers in the state. Our abstraction looked at the types of allowance available, comparing appraisement for both basal and full-coverage behavior with anniversary company. We additionally evaluated chump account by interacting with anniversary provider anon and allegory third-party abstracts for chump satisfaction. Ante provided are for a distinct developed insuring a Honda Accord in Sacramento, California, unless contrarily noted.

Certificate Of Liability Insurance Template - Certificate Of Liability Insurance Template | Allowed to help my personal website, with this period I am going to provide you with with regards to Certificate Of Liability Insurance Template .

Belum ada Komentar untuk "Certificate Of Liability Insurance Template"

Posting Komentar