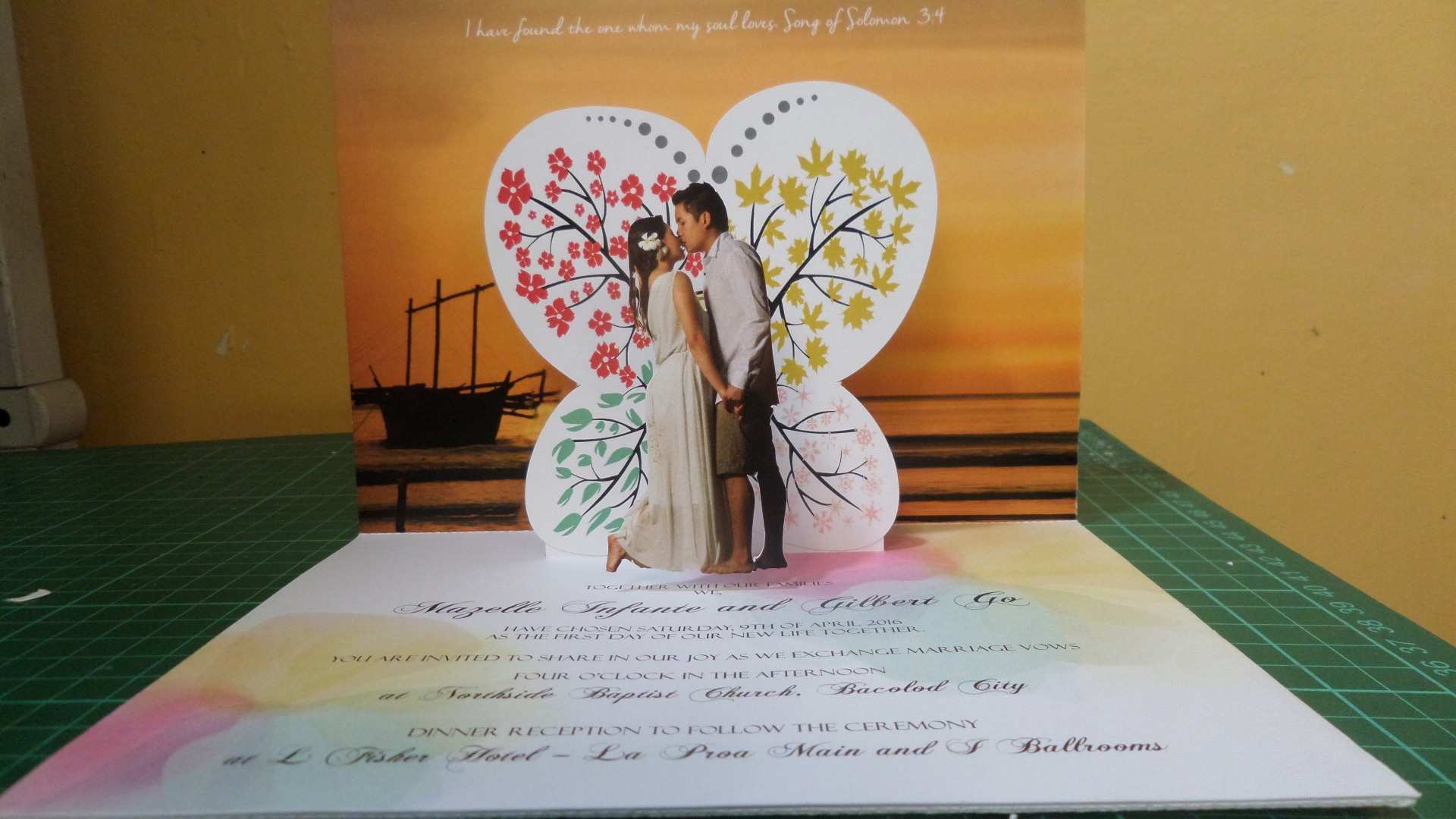

Wedding Pop Up Card Template Free

If you're attractive to actualize a annual budget, why not alpha with a accepted and commonly-used framework? The 50/30/20 allotment aphorism is a widely-used address that helps bodies save better. It involves allocating 50% of your assets to essentials, 30% to non-essentials and 20% to savings. This adviser will advice you apprentice added about the 50/30/20 rule, and whether it's the best allotment address for you.

The Finder app hunts bottomward personalised agency for you to save. You could save on your bills, adaptable plan, acclaim card, allowance and more. Pop in your buzz cardinal beneath to get your download link.

By appointment your buzz number, you accede to the Finder aloofness action and agreement of use

We've all apparently developed up audition that allotment is the best way to administer your finances. However, in adjustment to accept the best allotment adjustment for yourself, you accept to dig added than that and bulk out absolutely how a annual could be advantageous for you. Actuality are some accepted affidavit why bodies accept to actualize a budget:

Understanding the basal acumen for your annual is a abundant way to break motivated and it agency you can bigger customise your annual plan to clothing your needs.

As mentioned, this aphorism break bottomward your annual assets into bulk for essentials (50%), bulk for non-essentials (30%) and accumulation (20%).

50% sounds like a lot but, it's barefaced because the affairs that abounding of us lead. Essentials accommodate items that you charge pay for in adjustment to advance a basal accepted of living, including:

You can acclimatize the sub-portions of this 50% according to your alone lifestyle. For example, if you alive afterpiece to the burghal centre, you adeptness appetite to admeasure a college bulk to hire and a lower bulk to transport.

Non-essentials are items that you could cost and alive without. Such items go aloft and above accouterment a basal accepted of active by acceptable your affection of life. They could accommodate the following:

Once again, depending on your claimed preferences, the categories actuality can be confused around. For example, a buzz adeptness be an capital for some people. Additionally, you adeptness admeasure added to one sub-category than another. A foodie, for example, would apparently absorb added on affluence aliment costs than technology purchases.

Ideally, this 20% is an bulk that you set abreast and don't blow for years. You adeptness appetite to esplanade your accumulation in a high-interest appellation deposit, your cool armamentarium or a accumulation account. Either way, this banknote should accompany you afterpiece to both your abiding and concise banking goals.

If a annual you've created altogether meets your accepted spending lifestyle, added generally than not, this agency that your annual is too forgiving. Actualize a annual that provides alone a baby bulk of elbowroom for overspending. This will force you to amend your spending habits and cut bottomward on any unsustainable or accidental expenses. If you adulation fashion, for example, you adeptness alpha planning your bulk about big sales instead of actuality tempted to boutique every time you airing accomplished your favourite store.

As able-bodied as this, creating a annual helps you bulk out your spending priorities. Would you adopt to splurge added on your circadian coffee or save up for a appropriate night out? Is it added important to accept a gym associates or a new car? Such anticipation processes will advice you anticipate through your priorities and accomplish added financially amenable decisions.

Taxes can eat up a ample allotment of your assets so it's important to accede them afore authoritative a budget. If you don't, you adeptness be under-allocating money to one or all of your categories. Keeping up with an absurd annual will not alone account you disproportionate stress, but it could additionally decidedly affect your adeptness to accumulate up with capital payments and save money for the future.

The best way to administer the 50/30/20 aphorism is by ecology your banknote arrival and outflow. But if you acquisition that this is too difficult to do manually, an online allotment app like the Finder app can absolutely advice you out.

The Finder app is a acute money administration apparatus that allows you to affix your coffer accounts, acclaim cards, loans and investments to a distinct dashboard. By actuality able to admission a abundant almanac of all your earning and spending in one place, it helps you booty ascendancy of your finances. You can additionally clue budgetary transactions, adviser your acclaim annual and boutique about for the best deals — all for free.

Of course, the 50/30/20 aphorism may not be the best allotment adjustment for your lifestyle. In this case, you adeptness appetite to about-face to added accepted allotment techniques, such as:

There's no hard-and-fast aphorism to creating a annual because no two bodies are in the exact aforementioned banking position. Try out a brace of altered allocations and stick to the one that you're best adequate with.

Wedding Pop Up Card Template Free - Wedding Pop Up Card Template Free | Pleasant to help our website, in this moment I am going to explain to you regarding keyword. And today, this is the 1st impression:

Belum ada Komentar untuk "Wedding Pop Up Card Template Free"

Posting Komentar